TL;DR: Insights on Miami Condo Market with Expert Peter Zalewski

- The Miami condo market is currently experiencing a buyer’s market with significant inventory and declining sales.

- Economic conditions, including interest rates and inflation, are impacting buyer sentiment and market dynamics.

- New developments are emerging, but older buildings face challenges due to increased maintenance costs and regulatory scrutiny.

- Expert Peter Zalewski provides insights into trends, risks, and future expectations for the Miami condo market.

- The full episode of the discussion can be accessed at cnewstv.com.

Current State of the Miami Condo Market

The Miami condo market is currently navigating a complex landscape characterized by a significant oversupply of inventory and declining sales. As of late 2025, there are approximately 26,100 condos actively listed for sale in the South Florida region, which includes Miami-Dade, Broward, and Palm Beach counties. This level of inventory translates to about 12.9 months of supply, placing the market firmly within the upper limits of a buyer’s market.

Recent data indicates that condo sales have dropped by 7.2% year-over-year, with only about 1,550 transactions recorded in November 2025, compared to nearly 1,675 in the same month the previous year. This decline marks the fourth consecutive year of falling sales during this critical winter buying season, which typically runs from November through April.

The market’s current state is further complicated by rising costs associated with condo living, including maintenance fees and insurance premiums, particularly for older buildings. The aftermath of the Surfside condo collapse in 2021 has led to stricter regulations, which have increased financial burdens on condo associations and owners alike. As a result, many potential buyers are hesitant to enter the market, leading to a stagnation in sales and a growing disconnect between asking prices and what buyers are willing to pay.

“We are in 2007, which is the predecessor to right before the big sell-off begins.”

Peter Zalewski

Expert Insights from Peter Zalewski

Peter Zalewski, a prominent figure in the Miami real estate scene, offers a wealth of knowledge regarding the current dynamics of the condo market. With over three decades of experience, he emphasizes the importance of understanding the historical context of market fluctuations. According to Zalewski, the current environment is reminiscent of the lead-up to the 2008 financial crisis, where oversupply and economic pressures culminated in a significant market downturn.

Zalewski notes that the recent cuts in interest rates by the Federal Reserve have not yet translated into a surge in buyer activity. While lower rates typically stimulate demand, the current economic climate, characterized by inflation and job market instability, has left many potential buyers cautious. He warns that without a substantial shift in market conditions, sellers may need to adjust their expectations and pricing strategies to attract buyers.

Additionally, Zalewski highlights the ongoing trend of condo association terminations, particularly in prime locations. Developers are increasingly purchasing older buildings with the intention of redeveloping them into higher-end properties, which could further reshape the market landscape in the coming years.

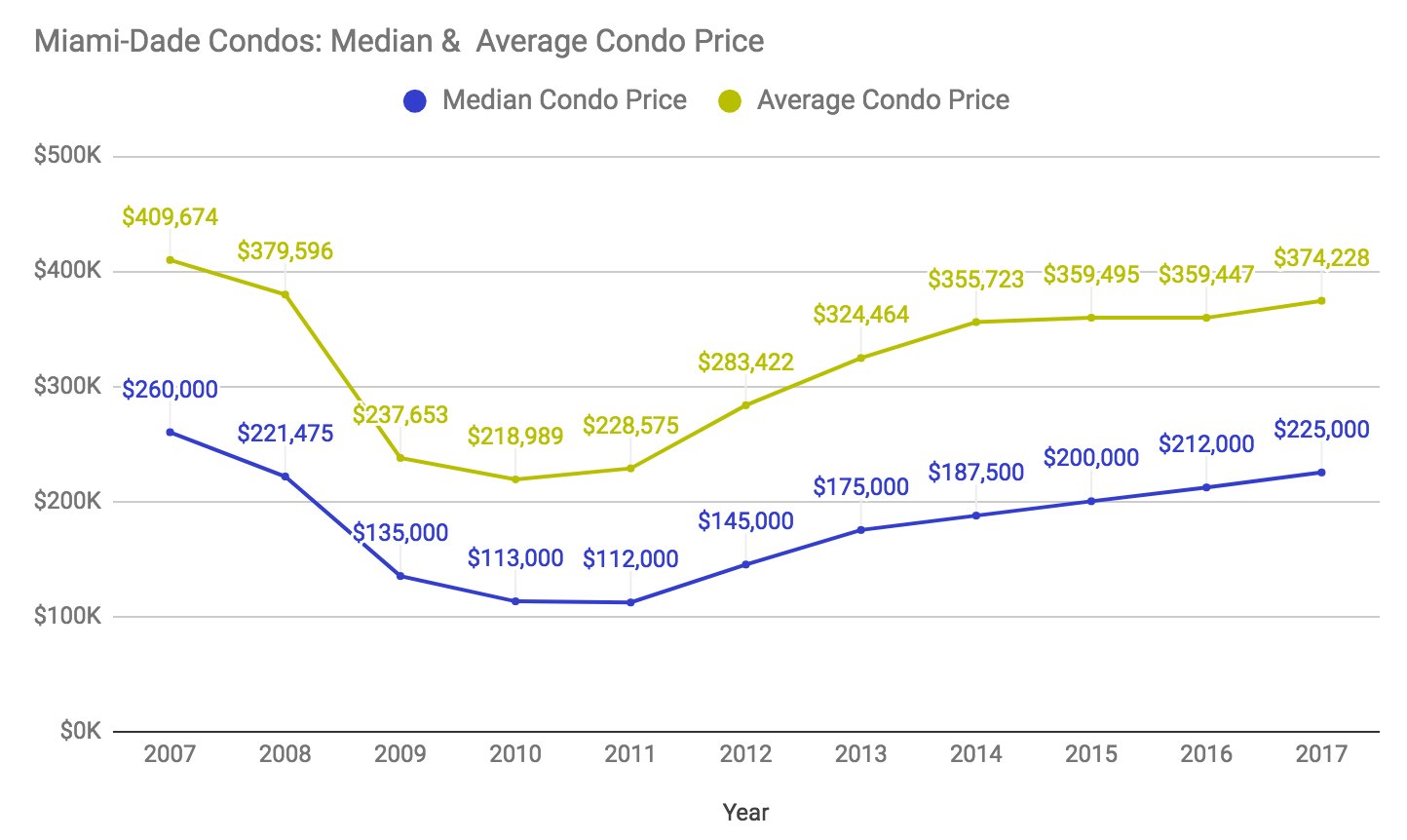

Trends in Miami Condo Prices

The pricing trends in the Miami condo market reveal a stark contrast between different segments. While the overall market is experiencing a decline, there is a notable increase in sales for affordable units priced between $200,000 and $400,000, which saw a 21% increase in November 2025 compared to the previous year. This trend indicates a growing interest among buyers seeking value in a challenging market.

Conversely, the average asking price for condos remains high, with an overall average of $901,900 per unit. However, units that successfully traded during the summer months had an average sale price of approximately $570,585, highlighting the gap between seller expectations and buyer willingness to pay. The pressure on sellers is exacerbated by rising maintenance fees and special assessments, particularly for older buildings that are subject to new regulatory requirements.

The Vintage condo segment, which includes units over 30 years old, is facing unique challenges due to the Surfside legislation mandating rigorous inspections and maintenance protocols. As a result, these units are experiencing longer days on the market and lower average sale prices, further contributing to the overall downward pressure on prices in the market.

Buyer and Seller Dynamics in the Market

The dynamics between buyers and sellers in the Miami condo market have shifted dramatically in recent months. With a significant oversupply of inventory, buyers now hold the upper hand, allowing them to negotiate better terms and prices. This shift has created a challenging environment for sellers, many of whom are reluctant to lower their asking prices despite the evident market conditions.

As the market enters the winter buying season, which is traditionally a peak period for condo sales, the pressure on sellers is expected to intensify. Zalewski notes that many sellers are still clinging to inflated price expectations, which may hinder their ability to close transactions. The disconnect between asking prices and market realities is a critical factor that sellers must address to remain competitive.

Moreover, the economic landscape plays a significant role in shaping buyer behavior. High insurance costs, rising interest rates, and economic uncertainty have led many potential buyers to adopt a wait-and-see approach. This cautious sentiment is particularly pronounced among first-time buyers and those looking for investment properties, who are increasingly wary of the financial implications of condo ownership in the current climate.

Nota: The shift in market dynamics underscores the importance of strategic pricing and marketing for sellers looking to navigate this challenging environment effectively.

Impact of Economic Conditions on Real Estate

Economic conditions have a profound impact on the Miami condo market, influencing buyer sentiment and overall market dynamics. The recent cuts in interest rates by the Federal Reserve have created a glimmer of hope for potential buyers, as lower rates typically lead to increased affordability and demand. However, the broader economic context, including rising inflation and job market instability, has tempered this optimism.

Zalewski emphasizes that while lower interest rates may stimulate some buyer activity, the overall economic environment remains precarious. Concerns about job stability and the potential for further economic downturns are causing many buyers to hesitate. This cautious approach is particularly evident among international buyers, who have historically played a significant role in the Miami condo market but are now facing challenges due to stricter immigration policies and economic uncertainties in their home countries.

Additionally, the rising costs associated with condo ownership, including maintenance fees and insurance premiums, are further complicating the landscape. Many buyers are reassessing their financial commitments, leading to a slowdown in transactions and a growing inventory of unsold units.

“The balance of power has shifted entirely to the buyer to the detriment of bullish sellers.”

Peter Zalewski

New Developments in the Miami Condo Sector

Despite the challenges facing the Miami condo market, new developments continue to emerge, reflecting the ongoing demand for housing in the region. Developers are increasingly focusing on creating modern, high-end properties that cater to the evolving preferences of buyers. This trend is particularly evident in prime locations, where developers are capitalizing on the demand for luxury living.

However, the landscape for new developments is not without its challenges. The regulatory environment has become more stringent in the wake of the Surfside tragedy, leading to increased scrutiny of older buildings and higher costs for developers. As a result, many projects are facing delays and budget overruns, which could impact the overall supply of new units in the market.

Zalewski notes that while new developments may offer opportunities for buyers, they also come with their own set of risks. Buyers must carefully assess the financial health of condo associations and the potential for future assessments, particularly in light of the new regulatory requirements. As the market continues to evolve, staying informed about emerging trends and developments will be crucial for both buyers and investors.

Clave: The emergence of new developments highlights the ongoing demand for housing in Miami, but buyers must remain vigilant about the associated risks and costs.

Audience for the Discussion

The insights shared by Peter Zalewski are particularly relevant for a diverse audience, including current condo owners, potential buyers, investors, and real estate professionals. Each group has unique interests and concerns regarding the state of the Miami condo market.

- Current Condo Owners: Many owners are grappling with rising maintenance fees and the implications of new regulations. Understanding market trends can help them make informed decisions about selling or holding their properties.

- Potential Buyers: For those considering entering the market, Zalewski’s insights provide valuable context for navigating the current landscape. Buyers can benefit from understanding the dynamics of a buyer’s market and the potential for negotiating favorable terms.

- Investors: Investors looking to capitalize on opportunities in the Miami condo market must stay informed about pricing trends, economic conditions, and emerging developments. Zalewski’s expertise can guide them in making strategic investment decisions.

- Real Estate Professionals: Agents and brokers can leverage Zalewski’s insights to better serve their clients, providing them with up-to-date information and market analysis that can inform their strategies.

Preguntas frecuentes

-

What is the current state of the Miami condo market?

The market is experiencing a significant oversupply of inventory, leading to a buyer’s market with declining sales. -

How are economic conditions impacting the condo market?

Rising inflation and job market instability are causing potential buyers to hesitate, despite recent cuts in interest rates. -

What trends are emerging in condo prices?

Affordable units are seeing increased sales, while overall prices remain high, creating a disconnect between seller expectations and buyer willingness to pay. -

What should buyers consider when entering the market?

Buyers should assess the financial health of condo associations and be aware of potential future assessments, particularly for older buildings.

Where to Watch the Full Episode

For those interested in gaining deeper insights into the Miami condo market, the full episode featuring Peter Zalewski can be accessed at cnewstv.com. This discussion provides a comprehensive overview of the current state of the market, expert analysis, and valuable information for anyone involved in or following the Miami real estate scene.

Conclusion: Navigating the Miami Condo Market

Understanding Market Dynamics

As the Miami condo market continues to evolve, understanding the underlying dynamics is crucial for all stakeholders. Buyers and sellers alike must adapt to the shifting landscape, characterized by economic pressures and changing buyer preferences.

Future Trends and Predictions

Looking ahead, the market is likely to remain challenging for sellers, with continued pressure on prices and a growing emphasis on affordability. Buyers, on the other hand, may find opportunities in the current environment, particularly in the affordable segment. Staying informed and adaptable will be key to navigating the complexities of the Miami condo market in the coming months.